Home is considered as the second basic needs of humans for their living, after food. So buying a home is always exciting, many of us have experienced this as a life-changing step. Homeownership gives a sense of security, also makes our lives more stable and comfortable. Particularly, in the Nepalese community, buying a home is considered a significant achievement in life with those mentioned above. With this legacy, members of the Nepalese community in Australia start saving their earnings for a first home deposit since they start working as a part-timer under a student visa. It may be one of the reasons Nepalese are significant home buyers in Australia.

It is the best idea to start saving from the first payslip if you have an Australian dream to own a live-in house. Start saving some of your hard-earned dollars for your first home deposit. Eventually, it will help you fund and manage family life in post home buying state. Though there are no hard and fast rules for saving for the future you can develop your own, you can get ideas from other’s experience. Draw a rough plan first, where you are at the stage, and where you want to be after five years, this would be your first systematic start.

Budget all your expenses

Once you got the idea, you are going to buy a home in Australia after permanent residency ending your international student life, start your saving plan. In the stage, make money goal, saving at least 20% for your first home deposit. Start budgeting your expenses and income, record your all outgoing money as well as incoming. Once you record your income and expenses, categories your expenses into three: essential, important, and flexible. Simply if you have a dream, you know what you should do.

Read Also: Getting your finances together before buying home

Make multiple saving accounts

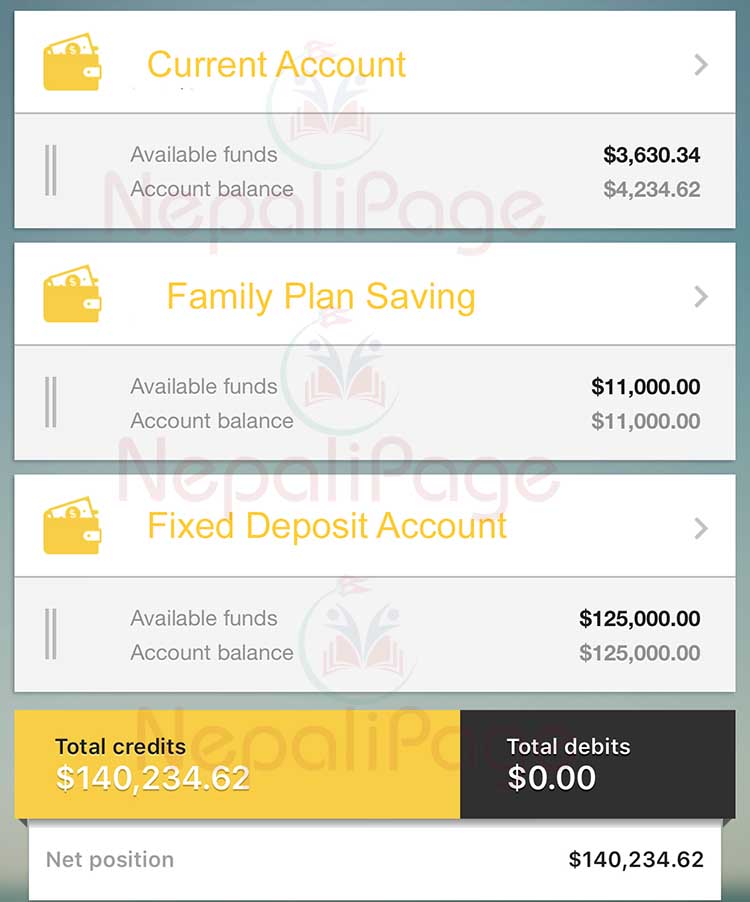

Planning and saving for a house is a long term goal because you are planning for a million dollars. There are other short and medium-term goals in life, too, so keep all goals separate and save them in a separate bank account. These days, you do not need to pay to keep multiple saving accounts and can be done through your app no need to go bank for that. Create at least three saving account if you are a student one for fees, another for family, and third for your first home deposit. Keep transferring funds frequently into that, a major percentage of saving for short-term goals and rest for the long term.

Don’t Miss: How to Manage Money in Australia?

Consider a short and medium-term investment

Once you started saving for your first home deposit, you are not going to spend that money on anything else. And, still, there are some years for your first home; it’s a good idea to invest your saving to make it grow a bit faster. Save that money in high-interest saving accounts or termed deposit would be an option that makes saving grow with time. Bonds, debentures, and capital note also other options for short term investment. If you do not have much idea on other investment options, keep those savings on high-interest accounts or term deposits.

Make use of your hobbies

Make the most of your hobbies and skills, to generate some extra income on top of your regular one. Especially when you are planning to live in Australia permanently once finished your study, you should make use of your all skills and hobbies. It’s a truth first emigrant generation needs to work hard to establish themselves. Photography, music, art anything you are enthusiast on, you can extend that hobby into a profitable leisure activity. You can be a YouTuber or event photographer even event singer, that would add value to your Australian dream.

Read This Too: Money Saving Tips for International Students