Studying in Australia? Get financial aid from these budgeting tips!

Nepalese students on arriving Australia get excited. Maybe the new place is charming enough to make them spend more? Or perhaps they have a lesser idea of budget management?

But Australia, despite has norms and regulations, have managed to woo the students to enjoy a luxurious life standard. Irrespective of the income and education status, Nepalese do enjoy spending amount on vacation, weekends party, spend on branded clothes, fine dining restaurant, latest iPhone and so on.

Therefore, living on a budget can be tricky, especially when you are totally in a bombastic mood to enjoy the Aussies lifestyle. But if you are one of those who are enjoying their freedom in fullest but fails to acknowledge the proper cash management, then lads you are inviting yourself in trouble.

While the holiday season offers plenty of free timing, the semester season will lock you up in college. With loads of assignment on hands and less working hours, you won’t be able to pay your fortnight rents and dues.

So, if you are eagerly waiting for the weekly paycheque, carefully read the article as we are sharing a few of the pro-money-saving tips while you are studying in Australia.

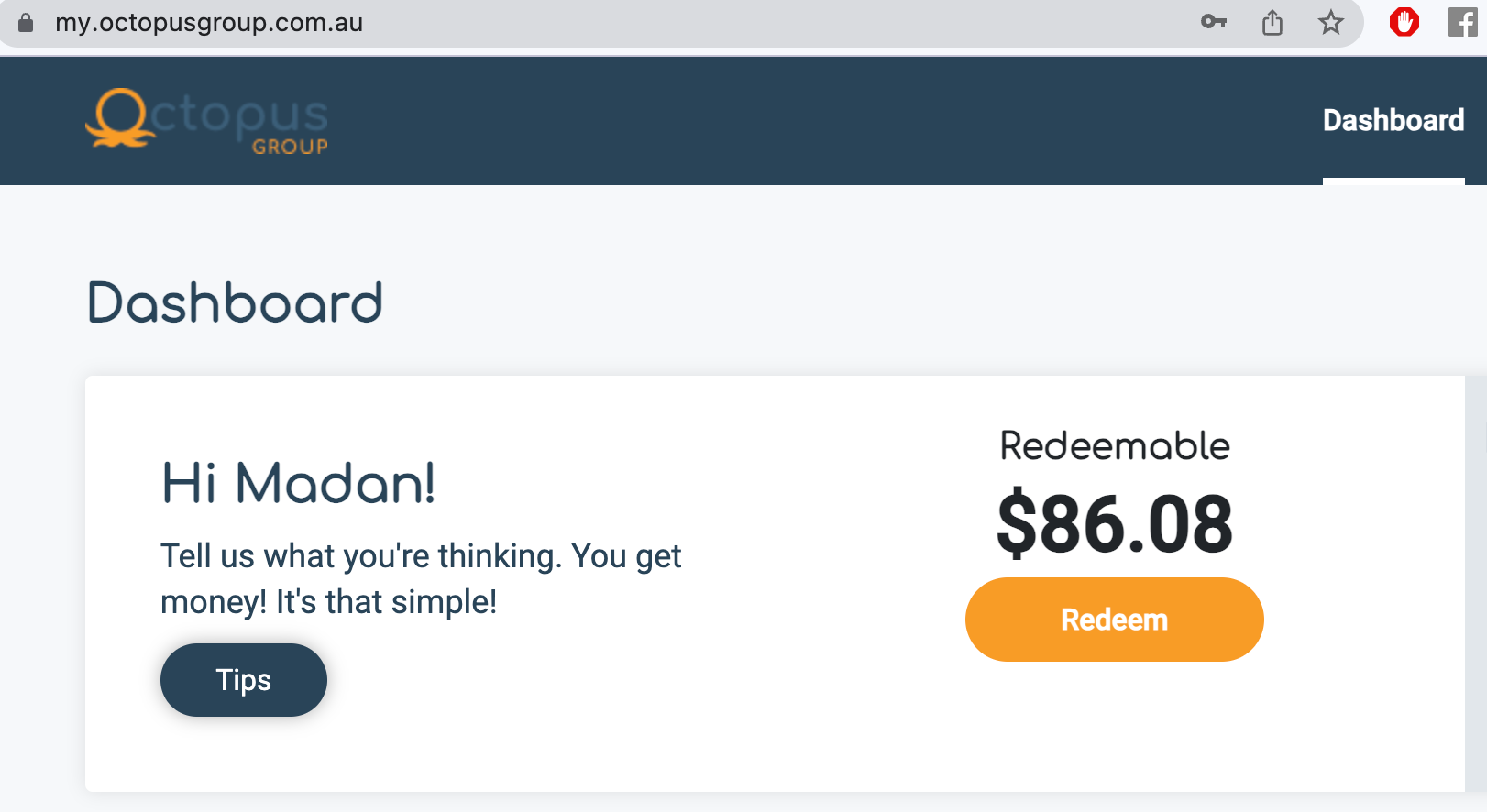

Tips to save dollars when studying in Australia

1.Break down your financial plan

Set a budget! Most of the Nepalese students studying in Australia when they like something or if they have a habit of using branded products, they refrain from discontinuing it. So, the keyway to keep track of the expenses is to set a weekly or monthly budget. List out the necessary costs- rent, utilities, groceries, mobile bills, and public transport. On the other side, jot down your incomes and savings. You will then be able to figure out the gross income, which you then can carry forward in your next month reserve or save it for tuition fees.

2. Look out for offers & sale

Supermarkets in Australia have daily deals, weekly deals, online purchase discounts, and point reward system. Make use of these. Stock up non-perishable goods and supplies. However, don’t fall in a lucrative trap as you may end up buying things you are not sure.

3.Strive for extra earning

Weekends job can give you extra cash. Likewise, instead of celebrating Christmas or going out a long vacation to nearby cities, Nepalese students can work overtime to earn additional dollars for their next semester tuition fee. On holiday season, the workers hike the hourly wage rate, which will be sufficient for the next two-three months when you jammed with an assignment. Or you could also babysit, tutor students, or hold a garage sale.

4. Use student card

Make the best possible use of student concession- transportation, movie, retail stores. These discounts will save up a few dollars.

5.Active participation

Walk to keep yourself fit. Instead of taking Uber use subways or bring bikes to the nearest destination to save up petrol or parking cost.

6. Pick alternative options as a means of entertainment

Nepalese know to enjoy a social life, and Australia has a great uni social event, which is, in fact, expensive, at times, as you run out of cash. Instead of attending university events of eating in fancy restaurants, you should cook your meal; this is cost-effective. Instead of tagging to cinemas, why not plan a movie night at home by yourself.

7. Search for student or weekly specials

The restaurants and bars have weekend brunch at half the original cost. Enjoy the cheap food and drink; you could make this a traditional or occasional visit.

8. Get home-packed lunch

Wake up early and pack yourself a nice lunch. It would save a few dollars. You can also bring in the evening leftovers or pack a nice healthy sandwich with a coffee pot.

9.Reap the second-hand options

You can save a lot in secondhand options. You can buy a textbook, clothes, gadgets, accessories, or furniture. You can look up for garage sales, online websites, or social media instead of buying firsthand expensive stuff.

10.Sacrifice & remain realistic

As a student, the source of income is limited, so keep a practical check on what you can afford, and what you can’t. If you want to save money, you have to sacrifice every big or small stuff.

All these handworks, sacrifice, cost-cutting will surely reap in the later years. As you won’t forever remain as a student. Once you complete the University, you are sure to get an attractive salary package. Till then, work hard and live up the moment.