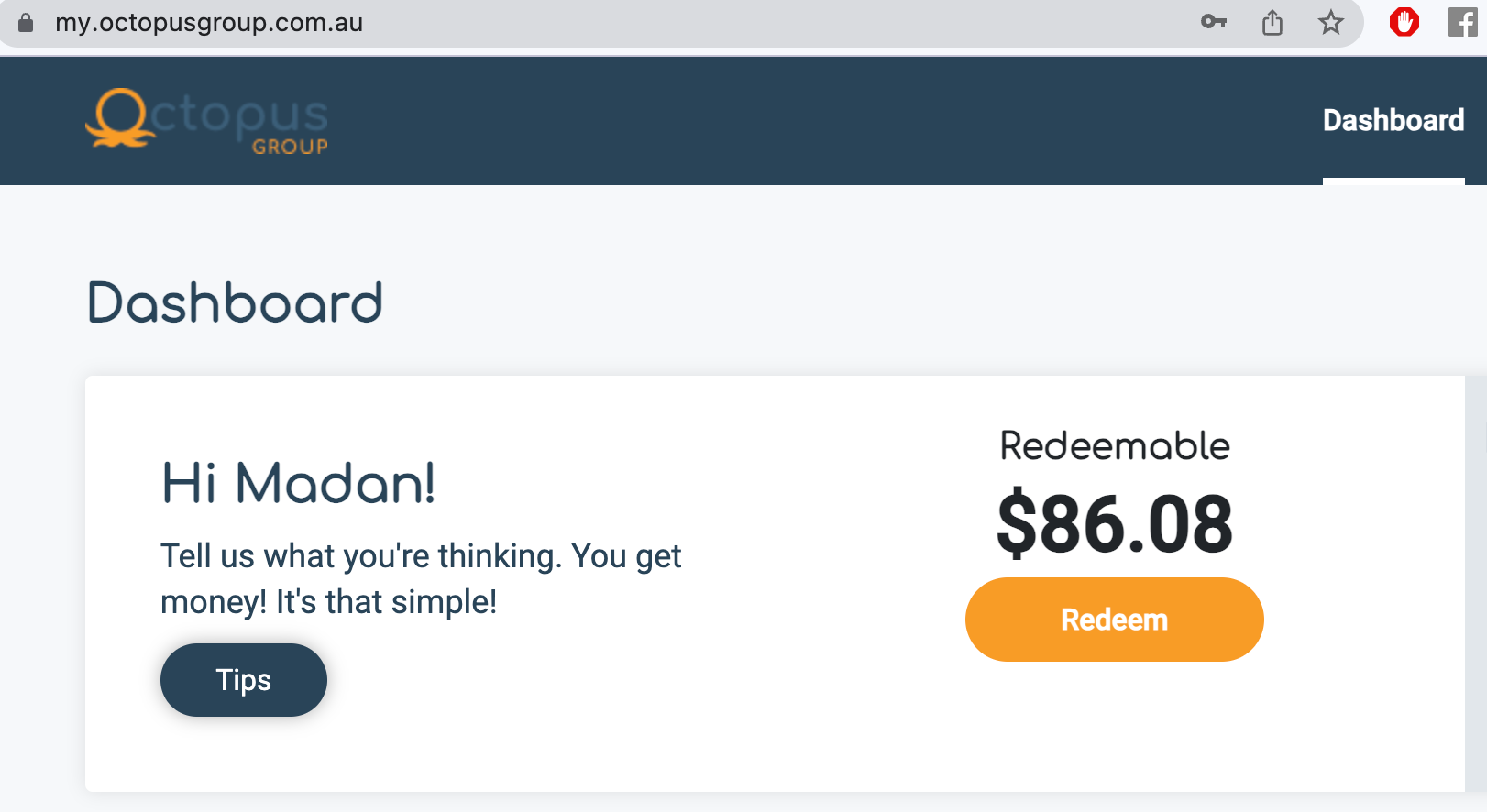

They say taking a credit card in Australia, increases the spending habit of a person, but how true can it be? On the other front, the easiness it provides when you have no cash in your pocket, to pay your bills is a boon. But remember, not all credit card gives the best deal.

So before getting excited and plunging into any random credit card offered in Australia, do a little bit of homework. Firstly, figure out your requirement and then compare the offers, perks and reward provided by the banks in the spending amount along with the credit limit, and the credit set-off time period. [ads2]

Basic fees levied on credit card service in Australia

| Introductory interest rate (honeymoon rates) | Limited time interest is offered for the new credit card. |

| Purchase interest rate | The interest rates imply after the completion of the introductory period. |

| Interest-free days | The duration of 44-45 days in which the interest is not levied on purchase. |

| Annual fee | The amount paid every year. |

| Reward fee | A fee which is paid for using the reward program. |

| Additional fees | · Late fees

· Cash in advance fees · Fees exceeding the credit limit · Fees used on travelling and shopping with a credit card. |

Which credit card feature should you consider?

Even if you are a frill spender or looking out to stack the rewards point you should always compare the credit card market to get the best sign deal. Here are the features one should look for when taking credit card:

Interest-free days

It is a time where a purchase can be made in zero interest. Usually, the credit period is in between 44-45 days and begins from the first day of the month till the next 45 days. However, if you fail to make payment by the end of the due date, you will no longer enjoy those interest-free days for the next statement period. To enjoy the interest-free period, you have to clear the pending balance.

Card Scheme

When looking for the best credit card in Australia, you are given three main schemes to choose from- master card, visa and express. Choosing one for the another can do make a difference. Here is a quick comparison:

- Policy for ‘zero liability’: The card must be protected from unauthorized transactions. If someone has fraudulently charged or made a purchase with your card you should be able to get your money back.

- Contactless payment: Tap and go system for payment made under $100.

- Reward point & freebies: Individual bank decides the offerings. So, compare the offerings provided by visa, master card and express and then decide to take the credit card. There are cards which adds reward point when used for purchasing travel tickets and shopping.

- Worldwide access: Visa card has access to more than 30 million locations.

- No annual fee: If you are a regular user of credit card, and pay your dues on time, your service provider should give you a service of ‘No annual fee’. There is some no annual fee credit card that offers several reward programs and other perks.

Complimentary Insurance

Platinum credit cards offering comes with great complimentary features including purchase protection, overseas travel insurance, extended warranty, and price protection.

When you apply for a credit card, do remember to ask the limit of cash spending offered to you, as it is the maximum spending amount offered to you. The amount the banks lend you should be paid within a tenure of maximum three years which is inclusive of interest rates.