With so many job holders fearing of getting struck by a disastrous recession after the COVID-19. Today, Prime Minister Morrison introduced ‘Job Keeper Payment’ a wage subsidy to retain maximum Australians employment despite the outbreak of COVID-19.

Through the scheme, the Australian government assures to support the diminishing economy to $320 billion or 16.4 percent of GDP. The program comes to immediate execution from 2020, March 30.

The Morrison government has given a historic subsidy to nearly 6 million workers who shall receive a flat payment of $1500 (before tax) fortnight, through their employer. The $130 billion ‘Job Keeper Payment’ package is keen to help the Australians tackle with the near economic crisis.

The payment released shall be equal to 70 percent of the national median wage, while for the employees working in hospitality, accommodation, retail sector shall receive a full median replacement wage.

Prime Minister Morrison adding more insight on the program said, “We will give millions of eligible businesses and their workers a lifeline to not only get through this crisis but bounce back together on the other side.”

He added,

“This is about keeping the connection between the employer and the employee and keeping people in their jobs even though the business they work for may go into hibernation and close down for six months.”

How does the Job Keeper Payment function?

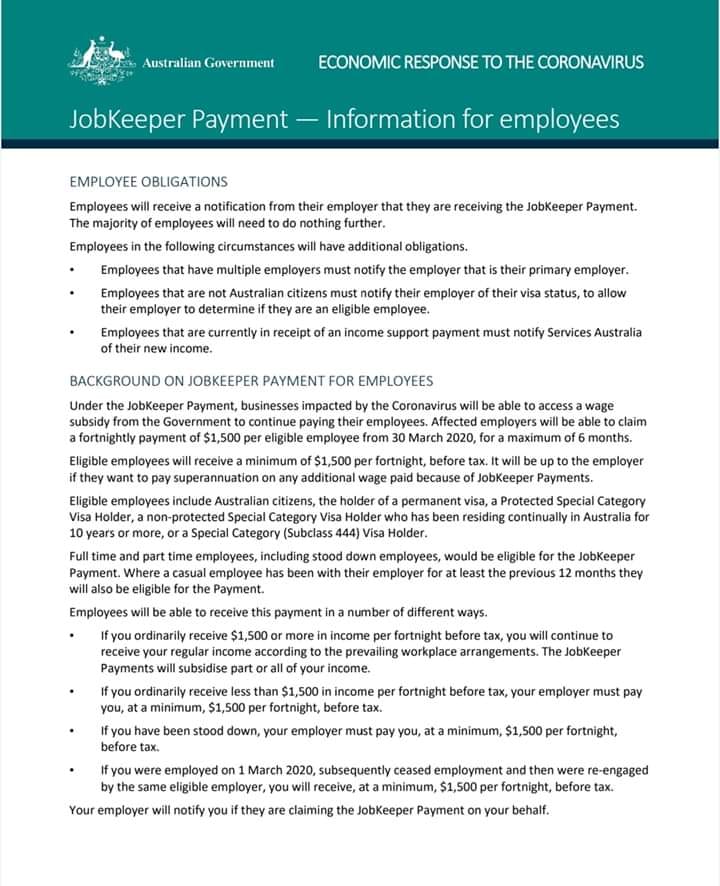

As part of the business subsidy, the payment shall be released to the respective employers for 6 months. The payment is eligible for those employers who have retained their employees after 2020, March 1.

Employers shall receive a fortnight payment of $1500 per employee. The first payment shall be released in the first week of May, as monthly arrears.

Who are eligible for the job keeper payment?

- Employers with an annual turnover of less than $1 billion have faced a significant reduction of 30% or more in revenue from 2020, March 1.

- Employers with an annual turnover of $1 billion facing a significant downturn of 50% in their revenue or more over a period of one month.

- Full time, part-time worker or casual worker who has been in the employment for the past 12 months with the employer are eligible for the program.

- Self-employed individuals are also eligible to receive the payment.

- Employees of Australian residents, working in New Zealand holding a subclass visa 444 and other migrants eligible for the Job Keeper Payment.

What type of entity is eligible for the payment?

- Partnership

- Companies

- Trusts

- Sole traders

- NPO (a non-profit organization)

- Charitable entities

An eligible business can apply for the Job Keeper Payment online via ato.gov.au